FTX court filing reveals former Alameda CEO’s $2.5M yacht purchase

The former Alameda CEO's $2.5 million yacht purchase is revealed in an FTX court filing

The payment to the American Yacht Group was disclosed under the category of payments benefiting any insider within one year before the crypto exchange collapsed.

FTX debtors have disclosed a series of financial statements revealing transactions that benefited company executives shortly before the major cryptocurrency exchange’s collapse in November 2022.

In a recent court filing with the United States Bankruptcy Court for the District of Delaware, several payments directly benefiting senior company executives at FTX and Alameda Research were disclosed, specifically, payments or property transfers executed within one year preceding the collapse of FTX.

However, FTX debtors state that there are no guarantees of the data’s absolute accuracy or completeness and disclaim any liability for errors or omissions.

Court filing in the U.S. Bankruptcy Court for the District of Delaware. Source: Kroll

In March 2022, a transaction of $2.51 million was directed from the company to the American Yacht Group, benefiting former Alameda Research co-CEO Sam Trabucco.

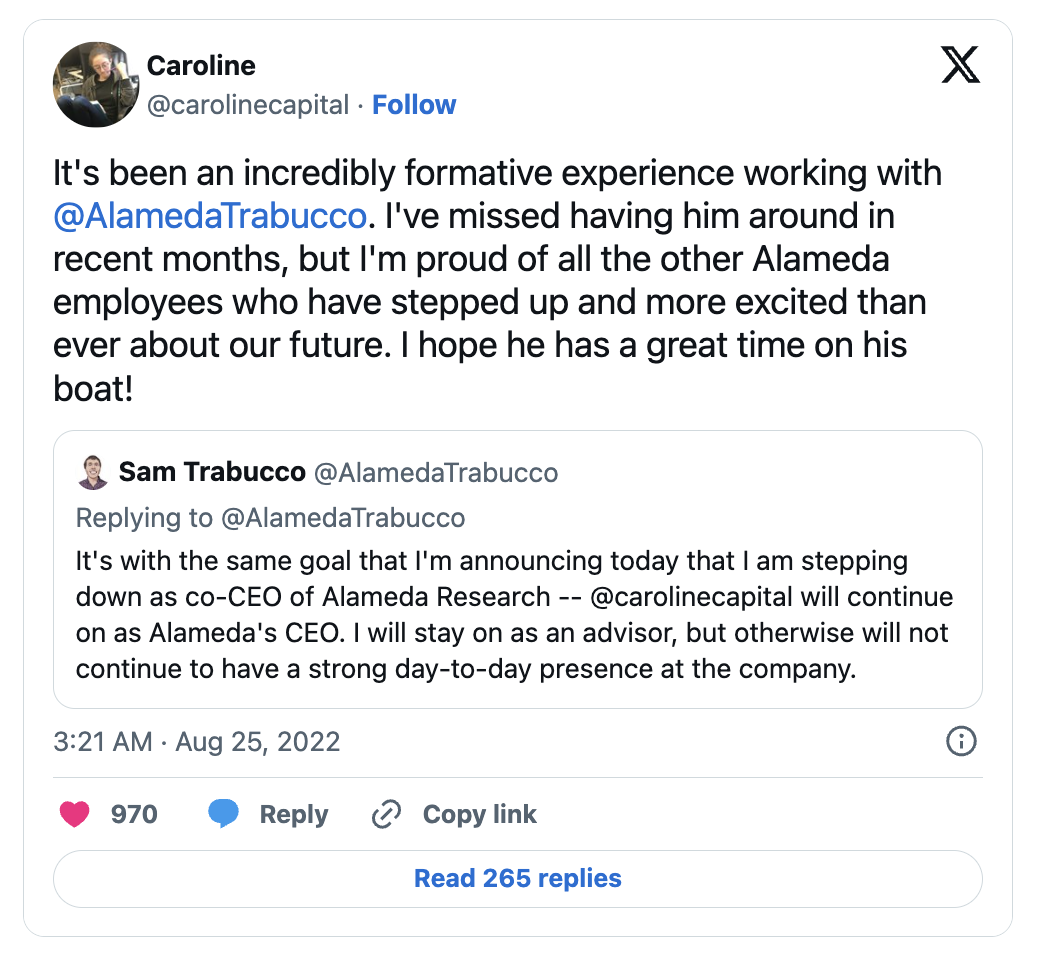

Just a few months after this transaction, Trabucco confirmed ownership of a boat while informing his followers about his resignation in an August 2022 tweet. In response to his tweet, Caroline Ellison, Alameda’s former co-CEO alongside Trabucco, wished him well and hoped he would savor more time on his boat.

Meanwhile, several cash payments were disclosed to former FTX executives, including Sam Bankman-Fried and Gary Wang, as well as former FTX director of engineering Nishad Singh, former FTX chief marketing officer Darren Wong, and former FTX chief operating officer Constance Wang, all within twelve months prior to the collapse.

However, it notes that the disclosures only pertain to fiat currency and the extent to which crypto transactions could be traced. “Responses to this question do not currently include all transfers of cryptocurrency, other digital assets or other assets,” it stated.

The filing also highlighted Bankman-Fried’s and FTX co-founder Gary Wang’s purchase of Robinhood shares in April 2022, totaling $35,185,242. They continued their acquisitions of Robinhood in May 2022, spending an additional $19.45 million. It discloses that Bankman-Fried held a 90% share ownership, with Wang owning the remaining 10% through their company, Emergent Fidelity Technologies.

However, in January, the U.S. Department of Justice seized the shares belonging to Bankman-Fried and Wang.

On Aug. 31, Cointelegraph reported that Robinhood had repurchased all shares previously owned by FTX and Alameda Research.

In a statement, Robinhood revealed that it had completed the purchase of 55,273,469 shares for roughly $606 million. Following the purchase announcement, Robinhood’s chief financial officer, Jason Warnick, expressed the company’s satisfaction with the outcome:

“We are happy to have completed the purchase of these shares and look forward to executing on our growth plans on behalf of our customers and shareholders.”

Bonus rebate to help investors grow in the trading world!

English

English